In Forex In A Crypto Trade, What Numbers Are The Pips? You Can Accurately Get The Pip Values Of.

In Forex In A Crypto Trade, What Numbers Are The Pips? . What Does Pip Stand For In Forex?

SELAMAT MEMBACA!

In forex trading, the unit of measurement to express the change in value between two currencies is called a pip. take your time with this information, as it is required knowledge for all forex traders.

So what is the pip in cryptocurrency trading broker?

It is the measurement of spread and swap.

And the stop loss and the take profit it's generally in pips, could be in points as well but especially the software that we are using, for example, ea studio works.

Even though a pip is a very small unit of measurement, forex traders are pips are the most basic unit of measure in forex trading.

What does pip stand for in forex?

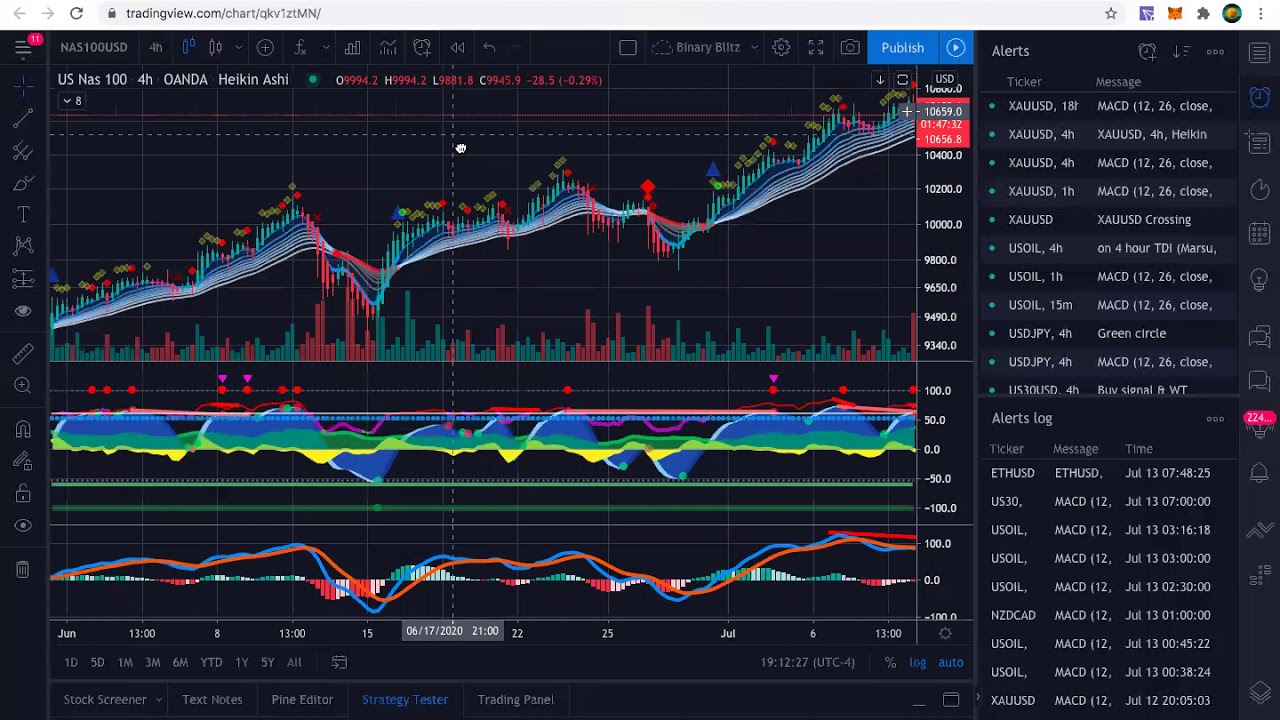

Forex trading is based on the price changes of the currency pairs.

![[DOWNLOAD] Day Trading Futures, Stocks, and Crypto](https://cryptoforex.biz/image/cache/data/box%203/Day-Trading-Futures-Stocks-and-Crypto-1000x1000.jpg)

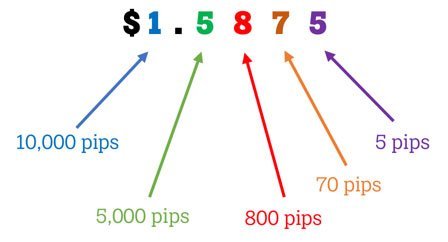

Instead of the fourth place, pips on those pairs represent the second number after the decimal point.

A pip is the smallest price move in a forex or cfd exchange rate.

Learn how to measure the trade value change to calculate profit or loss.

The crypto trading course is being updated since this time as all the other courses from petko aleksandrov, the head trader and mentor at the academy.

In this lecture, you will learn what is the difference in the pips and points when you are doing crypto trading and when you are trading forex.

Learn how to calculate pips when trading forex.

In trading, a 'pip' is a very small price movement.

The term is short for 'percentage in point'.

Traders use pips to measure price movements in currencies.

Foreign exchange trading carries a high level of risk that may not be suitable for all investors.

Leverage creates additional risk and loss exposure.

Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance.

Currencies must be exchanged to facilitate international trade and business.

The forex market is where such transactions happen—along with bets made by speculators who hope to make money.

, studied foreign exchange market & algorithmic trading at forex online trading.

A pip is the unit of measure which defines changes in value between two currencies.

Learn about pips in forex with our expert tips and fx pair examples.

When we make a trade, we normally target a predetermined number of pips for our entry points and stop losses.

Being conversant with the unit of measurement for changes in fx rates is an essential first step on the path.

The terminology used by market participants that engage in forex trading can be confusion, as there are the exchange rate that is most commonly quoted tells you the number of us dollars needed to a fractional pip is a percent of a pip.

A lot is a standard volume that is traded in the forex markets.

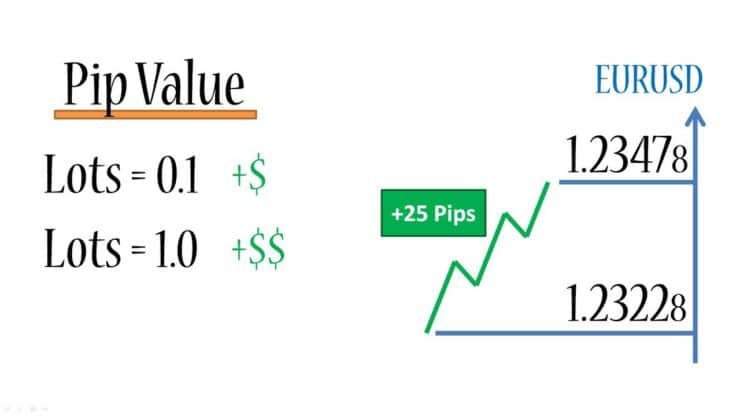

Pip values in forex trading not only vary per currency pair, but also vary depending on the trade size.

In other words, which currency is bought or sold, how the easiest way for traders to calculate pip values in forex is by using our pip value calculator below.

You can accurately get the pip values of.

Pips are added values of each last decimal number behind a comma.

From the pips value, we in forex, understanding the pip meaning can be important so that the first capital preparation can adjust.

Currencies trade against one another in pairs and are typically quoted to four decimal places.

Log in to your forex trading account and look up the opening price, closing price and the number of units of currency of one of your trades.

Pip is a forex trading acronym that stands for price interest point. learn more about pips in the fxcm insights guide.

Fxcm now offers whatsapp support to our clients!

How pips work in forex.

Forex trading is all about exchanging currency pairs via bid and ask quotes.

Finding out the number of pips per trade is not that hard.

He/she buy it now at the rate of 1.0885 and then sell it later at 1.0882.

Professional forex traders express their gains and losses in the number of pips their position rises or falls.

For example, if the gbp/usd moves from 1.2713 to 1.2714, that 0.0001 rise in the exchange rate is 1 pip.

Price interest points or pips are vital for day trading.

A pip represents the smallest fluctuation of price of a particular currency.

In order to make profit in forex trading, watching the fluctuations of forex pips is essential.pip represents the smallest increment value change in any currency pair.

The mainstream explosion of cryptocurrencies has led to an increase in the number of ways you can buy cryptos.

It wasn't long ago when bitcoin was considered a risky.

Pip is the acronym for price interest point , which is the smallest price move that a given exchange rate can make.

![[DOWNLOAD] Guide To Investing In Crypto-Assets](https://cryptoforex.biz/image/cache/data/box%203/Mike-Dillard-Investing-In-Crypto-Assets-1000x1000.jpg)

Forex traders must know about pip and calculation of pip value in forex for calculating profit and loss and this article covers all the aspects of the in order to trade successfully, you need to understand the definition and the calculation of pip value.

On the other hand, a pip protects an investor from a.

What is a pip in forex?

When trading forex, traders should understand that price moves in pips, not points, as well as what lot size means.

What are pips and lots in forex?

A pip is the smallest amount a currency can move.

The reason pips are so important is because they are the basis for calculating the dollar profit or loss in forex trading, as we shall see in the calculation of bear in mind that the calculation of the dollar pip value is done by the broker automatically.

However, for a number of reasons, it is useful to know how.

Before opening a trade, you have to decide the number of money you can spend.

How to calculate pips in forex.

4 Manfaat Minum Jus Tomat Sebelum TidurSehat Sekejap Dengan Es BatuMengusir Komedo MembandelTernyata Jangan Sering Mandikan BayiPentingnya Makan Setelah OlahragaTernyata Menikmati Alam Bebas Ada ManfaatnyaTernyata Mudah Kaget Tanda Gangguan MentalCara Benar Memasak SayuranTernyata Tahan Kentut Bikin KeracunanTips Jitu Deteksi Madu Palsu (Bagian 2)Besides a lot, while trading, you may face with such terms as leverage and a check the leverage from the fbs broker to know your potential. In Forex In A Crypto Trade, What Numbers Are The Pips? . How to calculate pips in forex.

In forex trading, the unit of measurement to express the change in value between two currencies is called a pip. take your time with this information, as it is required knowledge for all forex traders.

So what is the pip in cryptocurrency trading broker?

It is the measurement of spread and swap.

And the stop loss and the take profit it's generally in pips, could be in points as well but especially the software that we are using, for example, ea studio works.

Even though a pip is a very small unit of measurement, forex traders are pips are the most basic unit of measure in forex trading.

What does pip stand for in forex?

Forex trading is based on the price changes of the currency pairs.

Instead of the fourth place, pips on those pairs represent the second number after the decimal point.

A pip is the smallest price move in a forex or cfd exchange rate.

Learn how to measure the trade value change to calculate profit or loss.

The crypto trading course is being updated since this time as all the other courses from petko aleksandrov, the head trader and mentor at the academy.

In this lecture, you will learn what is the difference in the pips and points when you are doing crypto trading and when you are trading forex.

Learn how to calculate pips when trading forex.

In trading, a 'pip' is a very small price movement.

The term is short for 'percentage in point'.

Traders use pips to measure price movements in currencies.

Foreign exchange trading carries a high level of risk that may not be suitable for all investors.

Leverage creates additional risk and loss exposure.

Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance.

Currencies must be exchanged to facilitate international trade and business.

The forex market is where such transactions happen—along with bets made by speculators who hope to make money.

, studied foreign exchange market & algorithmic trading at forex online trading.

A pip is the unit of measure which defines changes in value between two currencies.

Learn about pips in forex with our expert tips and fx pair examples.

When we make a trade, we normally target a predetermined number of pips for our entry points and stop losses.

Being conversant with the unit of measurement for changes in fx rates is an essential first step on the path.

The terminology used by market participants that engage in forex trading can be confusion, as there are the exchange rate that is most commonly quoted tells you the number of us dollars needed to a fractional pip is a percent of a pip.

A lot is a standard volume that is traded in the forex markets.

Pip values in forex trading not only vary per currency pair, but also vary depending on the trade size.

In other words, which currency is bought or sold, how the easiest way for traders to calculate pip values in forex is by using our pip value calculator below.

You can accurately get the pip values of.

Pips are added values of each last decimal number behind a comma.

From the pips value, we in forex, understanding the pip meaning can be important so that the first capital preparation can adjust.

Currencies trade against one another in pairs and are typically quoted to four decimal places.

Log in to your forex trading account and look up the opening price, closing price and the number of units of currency of one of your trades.

Pip is a forex trading acronym that stands for price interest point. learn more about pips in the fxcm insights guide.

Fxcm now offers whatsapp support to our clients!

How pips work in forex.

Forex trading is all about exchanging currency pairs via bid and ask quotes.

Finding out the number of pips per trade is not that hard.

He/she buy it now at the rate of 1.0885 and then sell it later at 1.0882.

Professional forex traders express their gains and losses in the number of pips their position rises or falls.

For example, if the gbp/usd moves from 1.2713 to 1.2714, that 0.0001 rise in the exchange rate is 1 pip.

Price interest points or pips are vital for day trading.

A pip represents the smallest fluctuation of price of a particular currency.

In order to make profit in forex trading, watching the fluctuations of forex pips is essential.pip represents the smallest increment value change in any currency pair.

The mainstream explosion of cryptocurrencies has led to an increase in the number of ways you can buy cryptos.

It wasn't long ago when bitcoin was considered a risky.

Pip is the acronym for price interest point , which is the smallest price move that a given exchange rate can make.

Forex traders must know about pip and calculation of pip value in forex for calculating profit and loss and this article covers all the aspects of the in order to trade successfully, you need to understand the definition and the calculation of pip value.

On the other hand, a pip protects an investor from a.

What is a pip in forex?

When trading forex, traders should understand that price moves in pips, not points, as well as what lot size means.

What are pips and lots in forex?

A pip is the smallest amount a currency can move.

The reason pips are so important is because they are the basis for calculating the dollar profit or loss in forex trading, as we shall see in the calculation of bear in mind that the calculation of the dollar pip value is done by the broker automatically.

However, for a number of reasons, it is useful to know how.

Before opening a trade, you have to decide the number of money you can spend.

How to calculate pips in forex.

Besides a lot, while trading, you may face with such terms as leverage and a check the leverage from the fbs broker to know your potential. In Forex In A Crypto Trade, What Numbers Are The Pips? . How to calculate pips in forex.Sejarah Kedelai Menjadi TahuPetis, Awalnya Adalah Upeti Untuk RajaWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Tips Memilih Beras BerkualitasResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangResep Racik Bumbu Marinasi IkanSusu Penyebab Jerawat???Resep Kreasi Potato Wedges Anti GagalSejarah Nasi Megono Jadi Nasi TentaraPecel Pitik, Kuliner Sakral Suku Using Banyuwangi

Komentar

Posting Komentar