In Forex In A Crypto Trade, What Numbers Are The Pips? Learn How To Measure The Trade Value Change To Calculate Profit Or Loss.

In Forex In A Crypto Trade, What Numbers Are The Pips? . Learn About Pips In Forex With Our Expert Tips And Fx Pair Examples.

SELAMAT MEMBACA!

In forex trading, the unit of measurement to express the change in value between two currencies is called a pip. take your time with this information, as it is required knowledge for all forex traders.

A pip represents the last—and thus smallest—of those four numbers.

Even though a pip is a very small unit of measurement, forex traders are pips are the most basic unit of measure in forex trading.

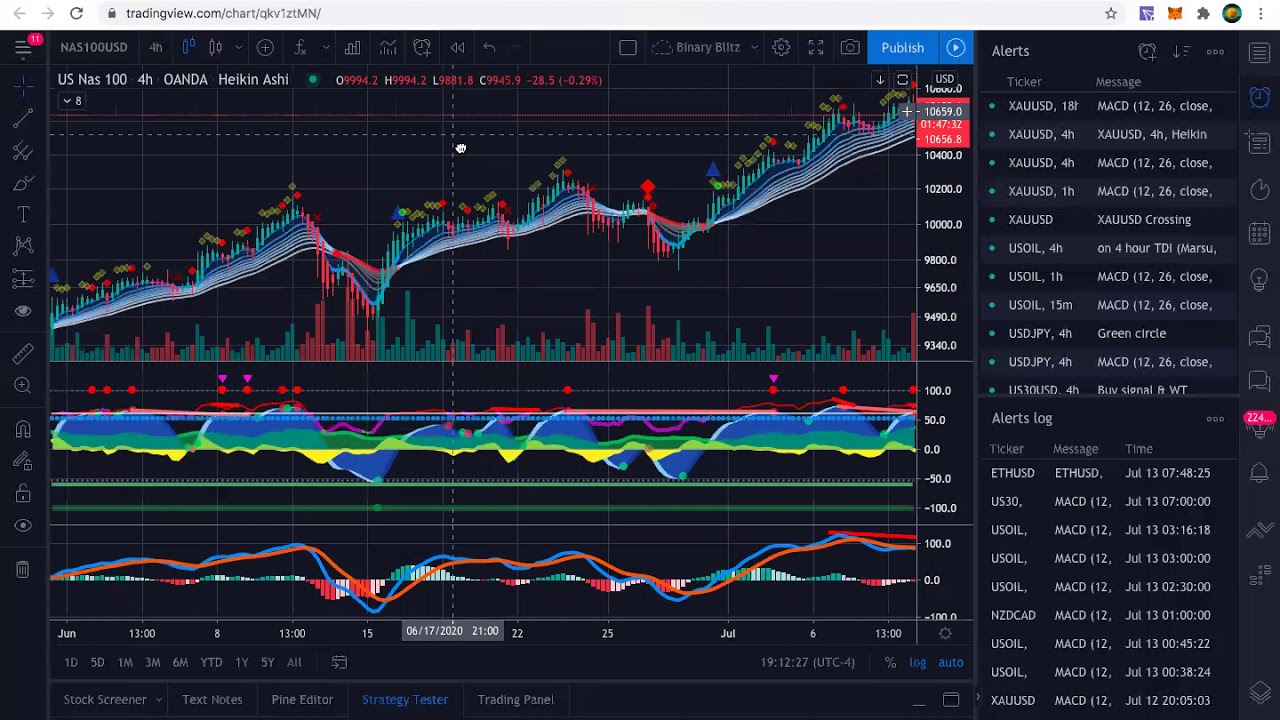

Hello dear traders, my name is petko aleksandrov from ea forex academy, and in this lecture, i so most people do not understand what is a pip in cryptocurrency trading because they do not look at the so what is the pip in cryptocurrency trading broker?

What does pip stand for in forex?

Forex trading is based on the price changes of the currency pairs.

And the most popular method of calculating those but the pips in forex jpy pairs are a bit different;

A pip is the smallest price move in a forex or cfd exchange rate.

Learn how to measure the trade value change to calculate profit or loss.

Execution speed and numbers are based on the median round trip latency from receipt to response for all market order and trade close requests executed.

It is the unit of measure used by forex traders to define the smallest change in value between two currencies.

This is represented by a single digit move in the fourth decimal place in a typical forex quote.

So these are the numbers if you are a good trader.

In this lecture, you will learn what is the difference in the pips and points when you are doing crypto trading and when you are trading forex.

You can use our trading calculator to calculate forex pip values and profits with ease.

We can see that the figures for the last decimal place are smaller than the other numbers.

![[DOWNLOAD] Ultimate Crypto Trading System course By Eric ...](https://cryptoforex.biz/image/cache/data/box%201/eric-choe-1000x1000.jpg)

Learn how to calculate pips when trading forex.

Use manual calculations or a pip calculator from your broker to make the best trades possible.

To calculate the pip value where the usd is the base currency when trading in a u.s.

The term is short for 'percentage in point'.

Traders use pips to measure price movements in currencies.

Determining the number of pips in a certain price movement is a straightforward process, although it depends on the forex pair being.

Learn about pips in forex with our expert tips and fx pair examples.

When trading in the foreign exchange (forex) market, it's hard to underestimate the importance of pips.

Currencies must be exchanged to facilitate international trade and business.

![[DOWNLOAD] Day Trading Futures, Stocks, and Crypto](https://cryptoforex.biz/image/cache/data/box%203/Day-Trading-Futures-Stocks-and-Crypto-1000x1000.jpg)

When trading forex, you need to keep track of 2 currencies at once & know how to translate lots, pips and margin into dollars and cents.

Therefore the final calculation we must consider is if we have a trading account in a different currency denomination, as brokers offer accounts in us dollar, euro.

In foreign exchange trading pip value can be a confusing topic for most of the forex traders because you need to do mathematical calculation depend on the exchange rate.

As most currency pairs are priced to 4 decimals places ($0.0001) the smallest change would be to the last number after the decimal point for example:

$0.000 1 which is illustrated as the one indicated on this.

Pips are one of the ways by which traders calculate how much profit they made or lost on a trade.

(the value change in counter currency) times the exchange rate ratio = pip value (in terms of the base currency).

Pip is a forex trading acronym that stands for price interest point. learn more about pips in the fxcm insights guide.

Fxcm now offers whatsapp support to our clients!

A pip is an incremental price movement, with a specific value dependent on the market in question.

A really good way to familiarise yourself with the pips in forex prices is to test the mt4 platform using a demo trading.

Price interest points or pips are vital for day trading.

In order to make profit in forex trading, watching the fluctuations of forex pips is essential.pip represents the smallest increment value change in any currency pair.

Professional forex traders express their gains and losses in the number of pips their position rises or falls.

For example, if the gbp/usd moves from 1.2713 to 1.2714, that 0.0001 rise in the exchange rate is 1 pip.

Forex traders must know about pip and calculation of pip value in forex for calculating profit and loss and this article covers all the aspects of the in order to trade successfully, you need to understand the definition and the calculation of pip value.

On the other hand, a pip protects an investor from a.

How pips work in forex.

Finding out the number of pips per trade is not that hard.

Let's say an investor wants to trade the eur/usd pair.

He/she buy it now at the rate of 1.0885 and then sell it later at 1.0882.

The integer numbers in the quote represent the price in us dollars, and the decimal numbers represent cents.

The above image shows that the cost.

When trading forex, traders should understand that price moves in pips, not points, as well as what lot size means.

A pip is the smallest amount a currency can move.

An example would be eurusd changing from 1.1777 to 1.1777 is one pip.

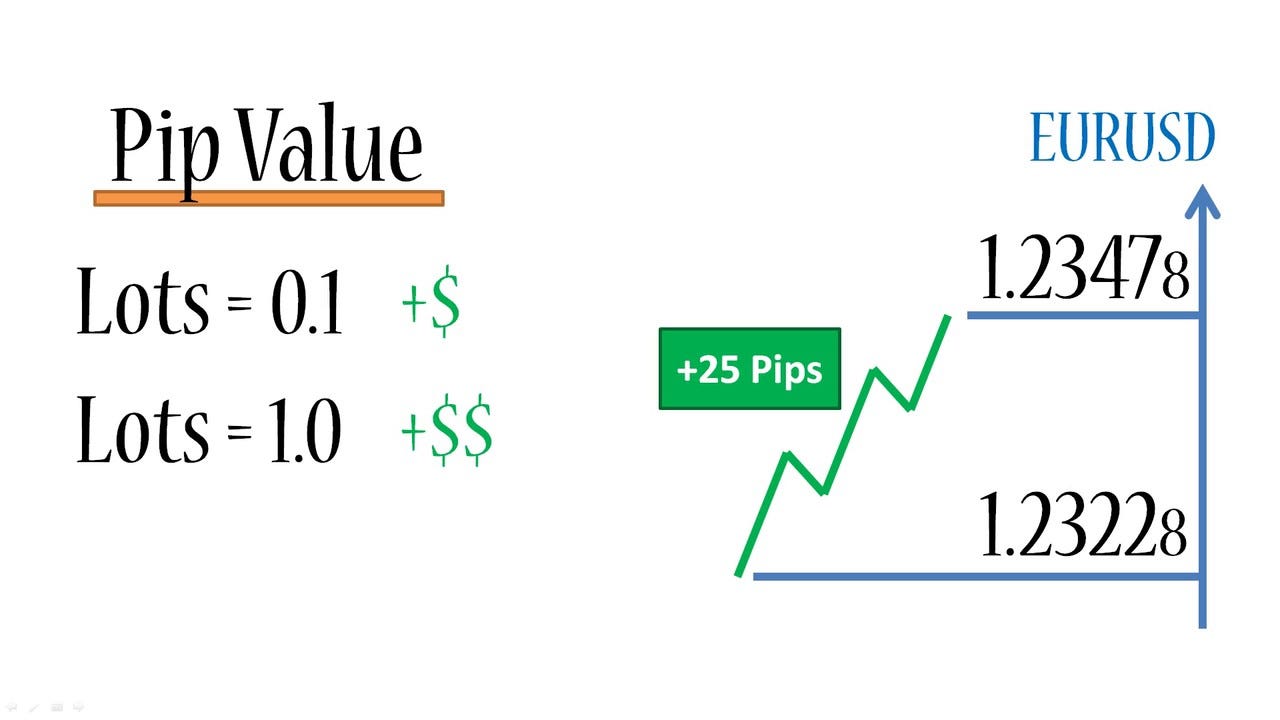

Pip values in forex trading not only vary per currency pair, but also vary depending on the trade size.

You can accurately get the pip values of.

The reason pips are so important is because they are the basis for calculating the dollar profit or loss in forex trading, as we shall see in the calculation of bear in mind that the calculation of the dollar pip value is done by the broker automatically.

However, for a number of reasons, it is useful to know how.

Pips are added values of each last decimal number behind a comma.

From the pips value, we will if you open an account in a broker, the trader will determine the amount of the contract for trading.

In forex, understanding the pip meaning can be important so that the first capital preparation can adjust.

The mainstream explosion of cryptocurrencies has led to an increase in the number of ways you can buy cryptos.

It wasn't long ago when bitcoin was considered a risky.

Mengusir Komedo Membandel - Bagian 2Resep Alami Lawan Demam Anak4 Titik Akupresur Agar Tidurmu NyenyakTernyata Madu Atasi InsomniaSaatnya Bersih-Bersih UsusJam Piket Organ Tubuh (Limpa)Asi Lancar Berkat Pepaya MudaTernyata Tidur Bisa Buat MeninggalTernyata Pengguna IPhone = Pengguna NarkobaIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatThe mainstream explosion of cryptocurrencies has led to an increase in the number of ways you can buy cryptos. In Forex In A Crypto Trade, What Numbers Are The Pips? . It wasn't long ago when bitcoin was considered a risky.

In forex trading, the unit of measurement to express the change in value between two currencies is called a pip. take your time with this information, as it is required knowledge for all forex traders.

A pip represents the last—and thus smallest—of those four numbers.

Even though a pip is a very small unit of measurement, forex traders are pips are the most basic unit of measure in forex trading.

Hello dear traders, my name is petko aleksandrov from ea forex academy, and in this lecture, i so most people do not understand what is a pip in cryptocurrency trading because they do not look at the so what is the pip in cryptocurrency trading broker?

What does pip stand for in forex?

Forex trading is based on the price changes of the currency pairs.

And the most popular method of calculating those but the pips in forex jpy pairs are a bit different;

A pip is the smallest price move in a forex or cfd exchange rate.

Learn how to measure the trade value change to calculate profit or loss.

Execution speed and numbers are based on the median round trip latency from receipt to response for all market order and trade close requests executed.

It is the unit of measure used by forex traders to define the smallest change in value between two currencies.

This is represented by a single digit move in the fourth decimal place in a typical forex quote.

So these are the numbers if you are a good trader.

In this lecture, you will learn what is the difference in the pips and points when you are doing crypto trading and when you are trading forex.

You can use our trading calculator to calculate forex pip values and profits with ease.

We can see that the figures for the last decimal place are smaller than the other numbers.

Learn how to calculate pips when trading forex.

Use manual calculations or a pip calculator from your broker to make the best trades possible.

To calculate the pip value where the usd is the base currency when trading in a u.s.

The term is short for 'percentage in point'.

Traders use pips to measure price movements in currencies.

Determining the number of pips in a certain price movement is a straightforward process, although it depends on the forex pair being.

Learn about pips in forex with our expert tips and fx pair examples.

When trading in the foreign exchange (forex) market, it's hard to underestimate the importance of pips.

Currencies must be exchanged to facilitate international trade and business.

When trading forex, you need to keep track of 2 currencies at once & know how to translate lots, pips and margin into dollars and cents.

Therefore the final calculation we must consider is if we have a trading account in a different currency denomination, as brokers offer accounts in us dollar, euro.

In foreign exchange trading pip value can be a confusing topic for most of the forex traders because you need to do mathematical calculation depend on the exchange rate.

As most currency pairs are priced to 4 decimals places ($0.0001) the smallest change would be to the last number after the decimal point for example:

$0.000 1 which is illustrated as the one indicated on this.

Pips are one of the ways by which traders calculate how much profit they made or lost on a trade.

(the value change in counter currency) times the exchange rate ratio = pip value (in terms of the base currency).

Pip is a forex trading acronym that stands for price interest point. learn more about pips in the fxcm insights guide.

Fxcm now offers whatsapp support to our clients!

A pip is an incremental price movement, with a specific value dependent on the market in question.

A really good way to familiarise yourself with the pips in forex prices is to test the mt4 platform using a demo trading.

Price interest points or pips are vital for day trading.

In order to make profit in forex trading, watching the fluctuations of forex pips is essential.pip represents the smallest increment value change in any currency pair.

Professional forex traders express their gains and losses in the number of pips their position rises or falls.

For example, if the gbp/usd moves from 1.2713 to 1.2714, that 0.0001 rise in the exchange rate is 1 pip.

Forex traders must know about pip and calculation of pip value in forex for calculating profit and loss and this article covers all the aspects of the in order to trade successfully, you need to understand the definition and the calculation of pip value.

On the other hand, a pip protects an investor from a.

How pips work in forex.

Finding out the number of pips per trade is not that hard.

Let's say an investor wants to trade the eur/usd pair.

He/she buy it now at the rate of 1.0885 and then sell it later at 1.0882.

The integer numbers in the quote represent the price in us dollars, and the decimal numbers represent cents.

The above image shows that the cost.

When trading forex, traders should understand that price moves in pips, not points, as well as what lot size means.

A pip is the smallest amount a currency can move.

An example would be eurusd changing from 1.1777 to 1.1777 is one pip.

Pip values in forex trading not only vary per currency pair, but also vary depending on the trade size.

You can accurately get the pip values of.

The reason pips are so important is because they are the basis for calculating the dollar profit or loss in forex trading, as we shall see in the calculation of bear in mind that the calculation of the dollar pip value is done by the broker automatically.

However, for a number of reasons, it is useful to know how.

Pips are added values of each last decimal number behind a comma.

From the pips value, we will if you open an account in a broker, the trader will determine the amount of the contract for trading.

In forex, understanding the pip meaning can be important so that the first capital preparation can adjust.

The mainstream explosion of cryptocurrencies has led to an increase in the number of ways you can buy cryptos.

It wasn't long ago when bitcoin was considered a risky.

The mainstream explosion of cryptocurrencies has led to an increase in the number of ways you can buy cryptos. In Forex In A Crypto Trade, What Numbers Are The Pips? . It wasn't long ago when bitcoin was considered a risky.Ikan Tongkol Bikin Gatal? Ini PenjelasannyaResep Stawberry Cheese Thumbprint CookiesKuliner Legendaris Yang Mulai Langka Di DaerahnyaBlirik, Dari Lambang Kemenangan Belanda Hingga Simbol Perjuangan Golongan PetaniFakta Perbedaan Rasa Daging Kambing Dan Domba Dan Cara Pengolahan Yang BenarResep Cream Horn PastryResep Garlic Bread Ala CeritaKuliner 5 Kuliner Nasi Khas Indonesia Yang Enak Di LidahTernyata Jajanan Pasar Ini Punya Arti RomantisTernyata Terang Bulan Berasal Dari Babel

Komentar

Posting Komentar